Avalara AvaTax is sales tax software that automates tax calculations and the tax filing process. AvaTax determines and calculates the latest tax rates based on location, article, legal changes, regulations and more. Extensive data checking and validation detects potential errors and discrepancies and fixes them immediately rather than in a later stadium.

When using AvaTax you will receive access to one central (cloud-based) platform. AvaTax is user-friendly and doesn’t require coding skills to apply or configure. At the same time, it is simple to connect with accounting (ERP), CRM, POS, and shopping cart systems.

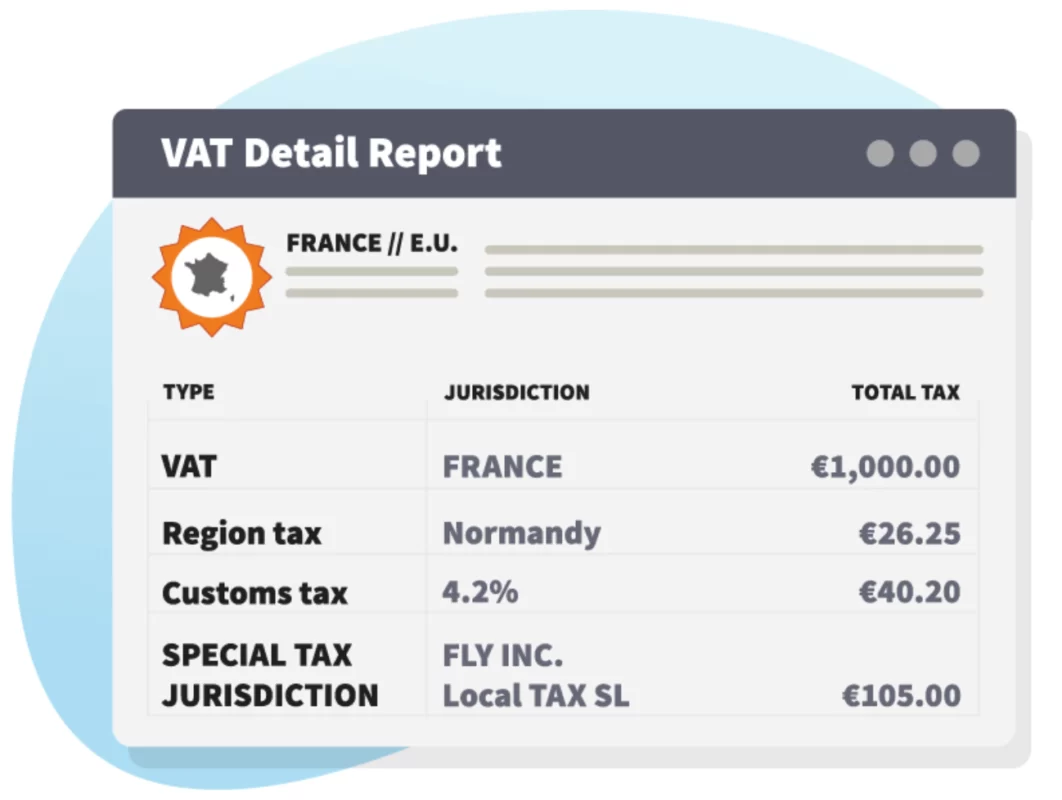

Use AvaTax for the following types taxes:

- Value-added tax (VAT)

- Sales and use tax

- Customs and duties calculations

- Goods and services tax (GST)

- Communications tax

- Excise tax

- Consumer use tax

- Lodging tax

- Beverage Alcohol tax

Benefits of using AvaTax

- Integration with ERP, CRM, POS, and shopping cart systems.

- Rate changes passed on immediately

- Threshold Insights

- Takes import costs into account

- Clear reports / Reliable research

- Advances transaction rules

- Address validation

- Cloud-based service

- Profiles for multiple businesses

Are you interested in AvaTax? Contact us for more information!

Nederlands

Nederlands